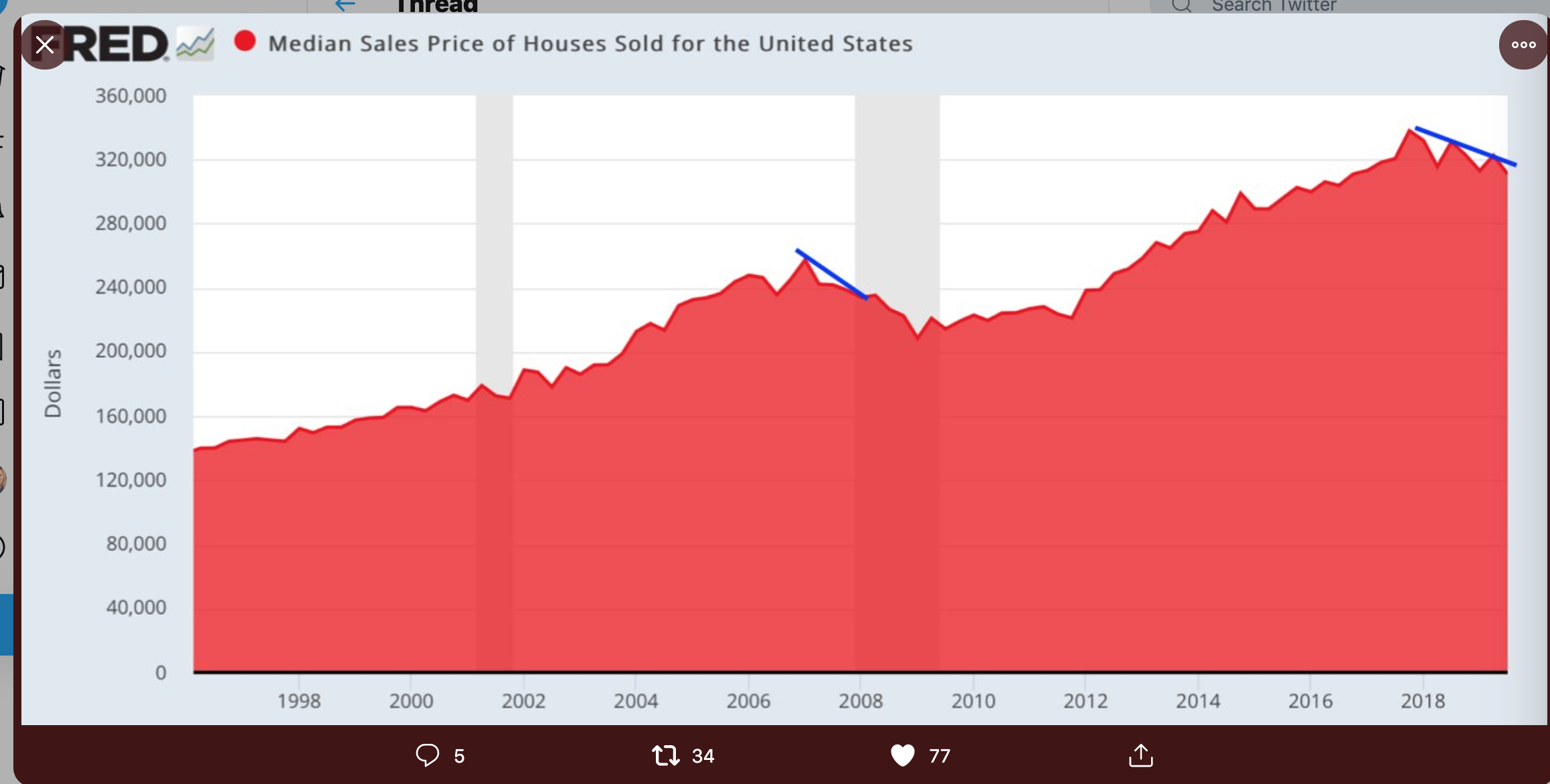

Changing Market

I saw this graph on Twitter today. I remember when the market crashed. It changed everything. I was just a little too young to have been buying homes yet because I was still in college, but it hit the economy and a lot of people hard because they were negative 20-60% equity on their homes and couldn't make their payments because they lost their job. Prices are getting high in my opinion from the standpoint of the first time home buyer market. I don't know the exact numbers but from my experience in south Minneapolis the under $300,000 home buyer really drives the market.

There are a lot of buyers right now and it seems like $400,000 is a little too high for most couples in Minneapolis to buy a home. A single persons comfort zones seems to be more like $200,000-$250,000. So what is going to happen? That is the main question I ask myself. I think they will lower interest rates to negative before they let prices drop. So in the short term it wouldn't be bad to get some property with super low interest rates. The key is being able to add equity out of the property and rent out for a positive cash flow. The city has changed some of the zoning laws which will make it easier to build duplexes and tiny houses. Tiny houses are the cheapest and easiest to build for the average person. There aren't a lot of builders out there that are going to build a home for $150,000-$300,000. There just isn't a lot of margin and there are lot of liabilities. I think it goes back to not getting over extended. That is the problem I see when we get in situations like this is. Many people get too confident and they chase the money too much. Supply is still very low in south Minneapolis though. The market will cool off for the next 6 months, but it will pick up again. South Minneapolis isn't going to be affordable like it once anytime soon.